Customized Solutions For Your AP Workflow Automation Needs. Automate Your AP Workflow For Improved Efficiency, Accuracy, and Control.

At DocuDriven, our solutions automate every step of your accounts payable workflow, from invoice capture to payment processing, reducing errors, speeding up approvals, and giving you greater control over your finances. Let DocuDriven enhance your efficiency and transform your AP operations with ease.

Do you prefer a “hands-on” approach to accounts payable automation?

Our solution is perfect for those who want to maintain full oversight while still benefiting from automation.

With our intuitive Records Management Software (RMS), you can easily monitor each invoice as it enters the system and follows an automated workflow process.

This gives you the flexibility to scan invoices and manually input indexing details, ensuring you stay in control while enhancing efficiency.

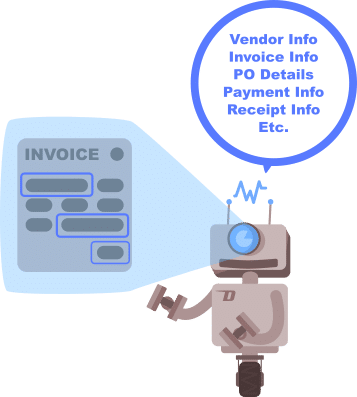

Take your AP automation to the next level with our “Forms Magic” technology.

This advanced feature uses Optical Character Recognition (OCR) to automatically recognize and index invoices from recurring vendors, significantly reducing the time spent on manual data entry.

By automating the indexing process, you can streamline your workflow, minimize errors, and free up valuable time for more strategic tasks.

Let us handle your entire accounts payable process with our comprehensive outsourcing solution.

We take care of everything—from collecting your invoices via a designated P.O. Box or a specialized email account, to scanning, organizing, and applying business rules to each invoice.

Our system can seamlessly interface with your accounting software to create journal entries automatically, and we provide a queue for invoices that require review and approval.

This solution simplifies your AP process, reduces administrative burdens, and ensures accuracy and compliance.

Learn about the top features and benefits of choosing our AP & workflow automation services.

Reduce processing costs by automating labor-intensive tasks, allowing your team to focus on strategic activities.

Eliminate errors caused by manual data entry, leading to more accurate and reliable information.

Accelerate your AP cycle times, think of more to talk about here. LOL. I’m so tired man.

Maintain compliance with industry regulations and internal controls, reducing the risk of fraud and errors.

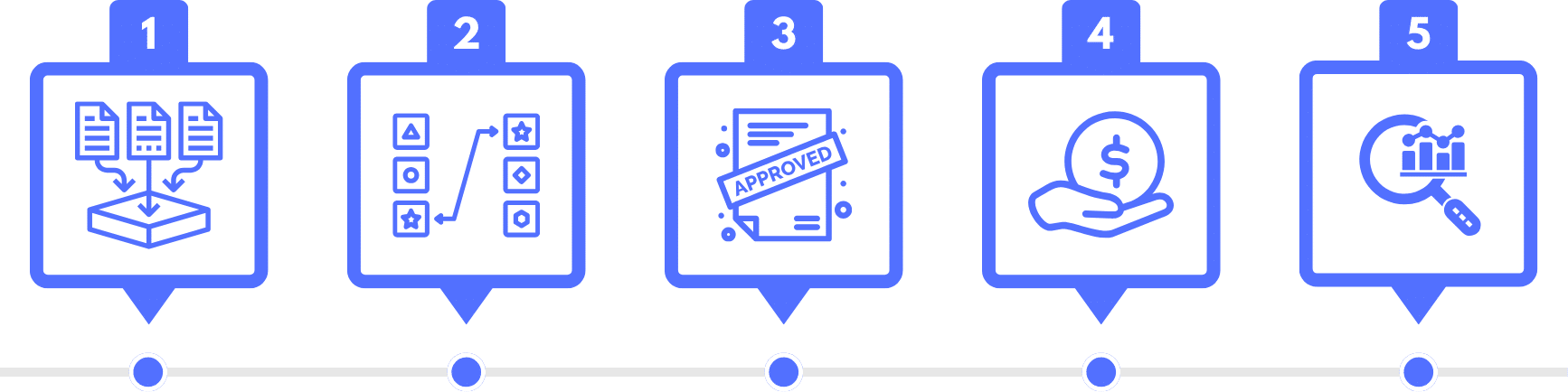

The first step in AP automation involves digitizing incoming invoices. Optical Character Recognition (OCR) technology scans and extracts data from paper-based invoices, converting them into digital formats. Simultaneously, e-invoicing systems allow vendors to submit invoices electronically, eliminating the need for paper transactions entirely.

Once the invoice data is captured, the system automatically matches the invoices with corresponding purchase orders and delivery receipts. This ensures that the billed items and terms match the original agreement. Automating this process helps quickly identify discrepancies, ensuring only accurate invoices proceed to the next stage.

Using predefined organizational rules, the AP automation system routes invoices to the appropriate personnel or department for approval. These rules may depend on factors like invoice amounts, vendors, or other criteria. The system can also send alerts and reminders to expedite the approval process, ensuring timely reviews, preventing overlooked invoices, and maintaining a clear audit trail of all approval actions.

After approval, the system manages the payment process, including scheduling payments to optimize cash flow, selecting preferred payment methods, and executing payments with minimal human involvement. Automating payments ensures timely settlements, helps take advantage of early payment discounts, and fosters strong vendor relationships.

Following payment execution, the system performs automatic reconciliation, matching payment transactions with bank statements to confirm accuracy in amounts and beneficiaries. AP automation tools also provide detailed reports on key metrics like spending trends, vendor performance, and potential cost-saving opportunities. This automated reconciliation reduces errors, eliminates manual checks, and offers financial teams valuable insights for strategic decision-making.

Want to see more case studies & testimonials? Click the button down below.

The timeline for implementing AP automation can vary based on the complexity of your existing processes, the volume of invoices, and system integration requirements. Typically, implementation can take anywhere from a few weeks to a couple of months. We work closely with your team to ensure a smooth transition, focusing on minimizing downtime and disruptions to your daily operations.

Yes, our AP automation and workflow automation solutions are versatile and can be customized to meet the needs of various industries, including manufacturing, healthcare, retail, finance, construction, and more. Whether you’re dealing with high-volume invoices, complex approval workflows, or industry-specific compliance requirements, our solutions can be tailored to your specific business needs.

Our AP automation system is designed to flag exceptions such as duplicate invoices, mismatched purchase orders, or discrepancies in pricing. These exceptions are routed to the appropriate team members for review and resolution. For disputed invoices, the system allows for quick collaboration between departments or external vendors to resolve issues efficiently while maintaining a full audit trail for compliance and future reference.

We provide comprehensive support throughout the entire implementation process, including initial setup, system customization, and staff training. After implementation, we offer ongoing technical support, system updates, and troubleshooting to ensure the automation continues to run smoothly.

Copyright 2024 © DocuDriven. All rights reserved.